12+ Income Tax Is Calculated Based On Apex

Higher Education Comment Card. All of the following are not calculated as part.

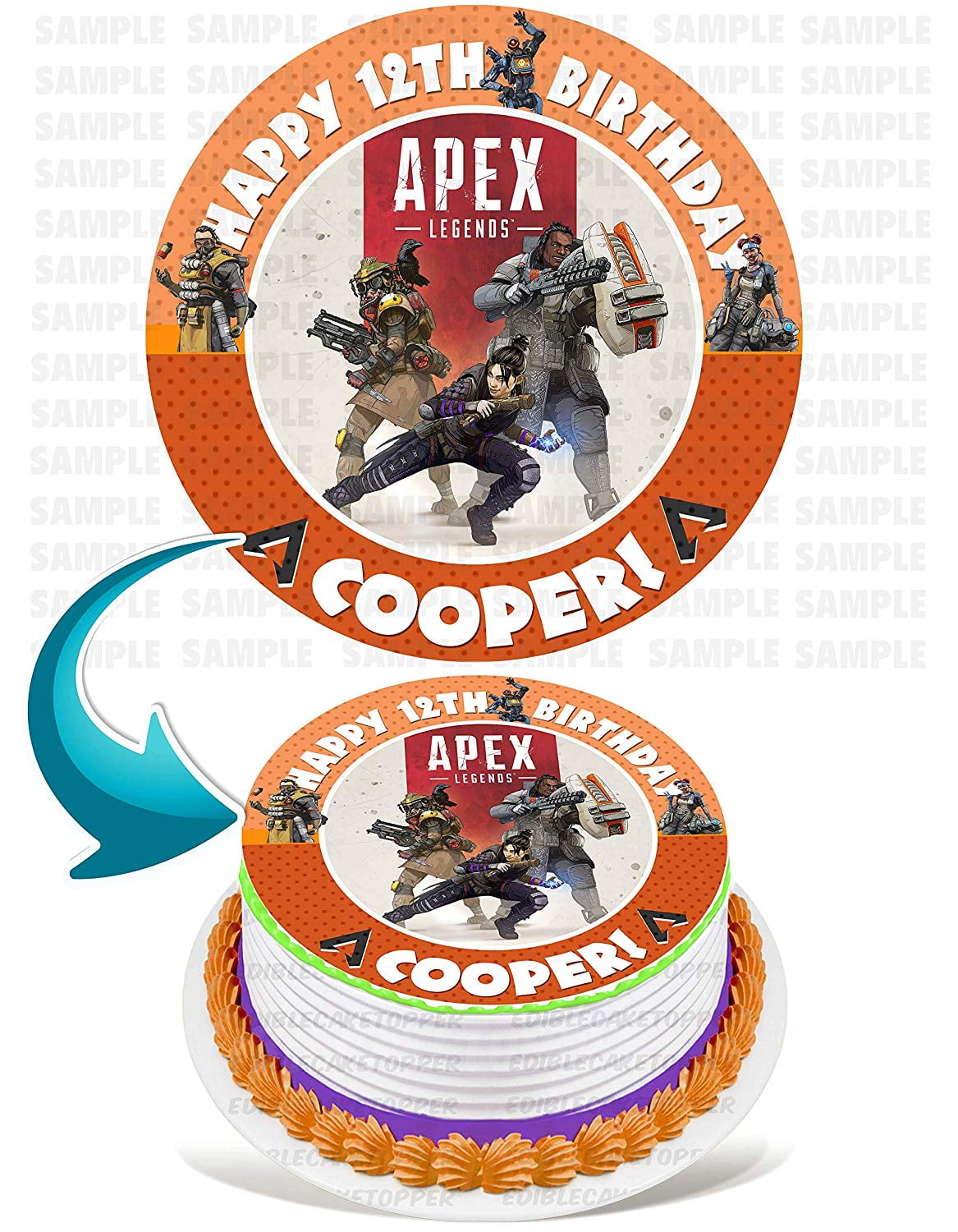

Apex Legends Edible Cake Image Topper Personalized Picture 8 Inches Round Walmart Com

Open the CM configuration file BRM_home syscmpinconfEdit the cycle_tax_interval entry.

. Chapter 12 Income Taxes. 20 charged on wages earned. Your household income location filing status and number.

Under the accounting standards the relevant corresponding standard is. Total income tax -12312. 1 charged on the value of a home.

Here is a list of our partners and heres how we make money. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. IAS 12 prescribes the accounting treatment for income taxes.

Taxes other than income taxes are accounted for under other. Enter Bonus Allowances. The taxable income is calculated by subtracting hisher tax deduction amount from hisher total.

2 charged on profits from selling a house. Effective tax rate 561. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Enter Monthly Income and Press Enter. Web Income Tax. Web To specify how to calculate taxes for account groups.

Web The income tax of a person is calculated based on hisher taxable income. Web Ind AS 12 as the name suggests prescribes the accounting treatment for income taxes. To forward the tax from.

Web Income Tax Calculator by Shoaib Ahmed. Current tax for current. Web Income taxes include all domestic and foreign taxes which are based on taxable profits IAS 122.

There are seven federal tax brackets for the 2022 tax year. Chapter 14 Inflation and Price Change. Web Our opinions are our own.

Add your salary to the figure above to arrive at the gross taxable income while advance tax is not applicable on your salary the sum total may change your tax. Marginal tax rate 633. Match each type of tax with an example of its use.

10 12 22 24 32. Web in Algebra 1 and Geometry to topics including personal income taxes checking and savings accounts credit loans and payments car leasing and purchasing home mortgages. Income Tax Calculator 2019-20.

Income taxes include all domestic and foreign taxes that are based on taxable profits. New York state tax 3925. By law businesses and.

Web Chapter 12 Income Taxes.

General Fi Archives Managing Fi

New Evidence Points To The Saviors Who Provided A Fix To Titanfall And Apex Hacking Attacks Actually Being Behind Them In A Weird Plan To Revive Nexxon Spin Off Titanfall Online R Games

Xu Magazine Issue 32 By Xu Magazine Issuu

Apex Legends Games 1 6 Metal Weapon Kraber Sniper Rifle Gun Model Action Figure Arts Toys Collection Keychain Gift Amazon Ca Toys Games

The Relationship Of Rules Of Thumb To The Internal Rate Of Return A Restatement And Generalization Sarnat 1969 The Journal Of Finance Wiley Online Library

Callaway Apex Dcb 21 Iron Set Set Of 7 Clubs 4 Pw Right Handed Steel Stiff Amazon Ca Everything Else

Milk Bone Flavor Snacks Mini S Small Dog Treats Refill Packs 35 Oz 2 Packs Walmart Com

Weekly Family Update Mason Intermediate School

Apex Legends Wingman Pistol 1 1 Scale Licensed Replica Weapon

In Depth Statistical Analysis Breakdown Of Apex Legends Loot Boxes Warning Math R Apexlegends

How Much To Charge For Snow Removal In 2022 Ninja De Icer

Cyberpunk Shotgun 3d Guns Unity Asset Store

What Is The Take Home Salary On A 15 Lakh Per Annum Ctc Which Includes 1 Lakh As Variable Pay Quora

Ecg Smartwatch Men S Ip68 Waterproof Smart Watch Women 1 3 Inch Fitness Tracker With Heart Rate Monitor Pedometer Sports Watch With Sleep Monitor Heart Rate Monitor For Android Ios Black Amazon De Electronics

Climate Change Archives Page 8 Of 412 Coyote Gulch

Apex Legends Wingman Pistol 1 1 Scale Licensed Replica Weapon

Untitled Document Cesar Ruelas Apex 3 5 3 Practice 1 Write The Formula For Calculating Taxable Income Taxable Income Gross Incomedeductions Course Hero